To budget for long-term travel, estimate expenses and set a savings target. Consider living costs, transportation, and emergency funds.

Cherishing the dream of long-term travel starts with a solid financial plan.

Budgeting effectively means dissecting potential costs and pinpointing how much money you will need.

Begin by researching your desired destinations to gather information on daily living expenses.

Factor in accommodation, food, local transport, and attractions.

Account for flights, visas, and insurance, which can significantly impact your budget.

Don’t forget to include a cushion for unexpected expenses that may arise during your travels.

Regularly track your expenses and adjust your budget as needed to stay on course.

By taking a strategic approach to your finances, you can ensure your long-term travel is both exhilarating and economically sustainable.

Table of Contents

Toggle- Embracing A Financially Savvy Mindset

- Setting Your Travel Goals

- Breaking Down The Costs

- Creating A Savings Plan

- Harnessing Technology For Budgeting

- Cutting Expenses Pre-travel

- Generating Additional Income

- Finding Affordable Accommodations

- Tackling Transportation Costs

- Staying Financially Responsible While Traveling

- Frequently Asked Questions Of How To Budget For Long-Term Travel

- Conclusion

Embracing A Financially Savvy Mindset

Setting off on a long-term travel adventure thrills the heart and stirs the mind.

It asks for more than just packing bags and booking flights.

Long-term travel seeks a financially savvy mindset to ensure a journey free from fiscal woes.

The cornerstone of this approach lies in adopting smart money habits well before your departure date.

Adopting A Traveler’s Fiscal Mentality

Traveling for extended periods means stepping outside the comfort of routine expenses. Adopting a traveler’s fiscal mentality involves strategic thinking:

- Recognize priorities: Cut non-essential expenses to save more.

- Opt for minimalism: Sell items you don’t need for extra cash.

- Research destinations: Choose places with a lower cost of living.

- Plan and track: Use budgeting apps to monitor spending habits.

Adopting this mindset transforms how you view your finances, focusing on saving for experiences over items.

The Psychology Of Saving For Adventure

Mindset shifts are critical for successful budgeting. Understanding the psychology behind saving helps:

- Create goal-oriented savings: Define clear targets for your travel funds.

- Visualize the benefits: Imagine the rich experiences ahead.

- Practice patience: Appreciate the growth of your travel fund.

- Acknowledge sacrifices: Small lifestyle changes lead to significant savings.

Saving becomes part of the adventure, building excitement and anticipation with each step closer to your goal.

Setting Your Travel Goals

Starting on long-term travel begins with clear goals. Know what you want from your adventures.

It’s the map that guides your budgeting journey. Let’s dig into shaping those dreams into tangible targets.

Defining Your Travel Dream

Imagine your perfect trip. What does it look like? Is it lounging on tropical beaches, exploring ancient ruins, or perhaps crossing multiple continents? Let’s break this down:

- Destinations: List the places you must see.

- Experiences: Note the activities that excite you.

- Comfort: Decide on accommodation and travel styles.

- Local life: Consider if immersive cultural experiences are vital.

These preferences determine your travel budget’s shape and size. So, define what matters most to you.

Timeline: Short Breaks Vs. Extended Journeys

The length of your travels can drastically affect your budget. Compare the two:

| Short Breaks | Extended Journeys |

|---|---|

| Frequent mini-vacations | One long, continuous trip |

| Higher daily costs | Spread expenses over time |

| Limited time means selective experiences | More flexibility and immersive experiences |

| May require less planning | Needs thorough preparation |

Reflect upon your timeline and how it aligns with your goals. Whether it’s escaping for weekends or a six-month odyssey, craft a timeline that serves your dream best.

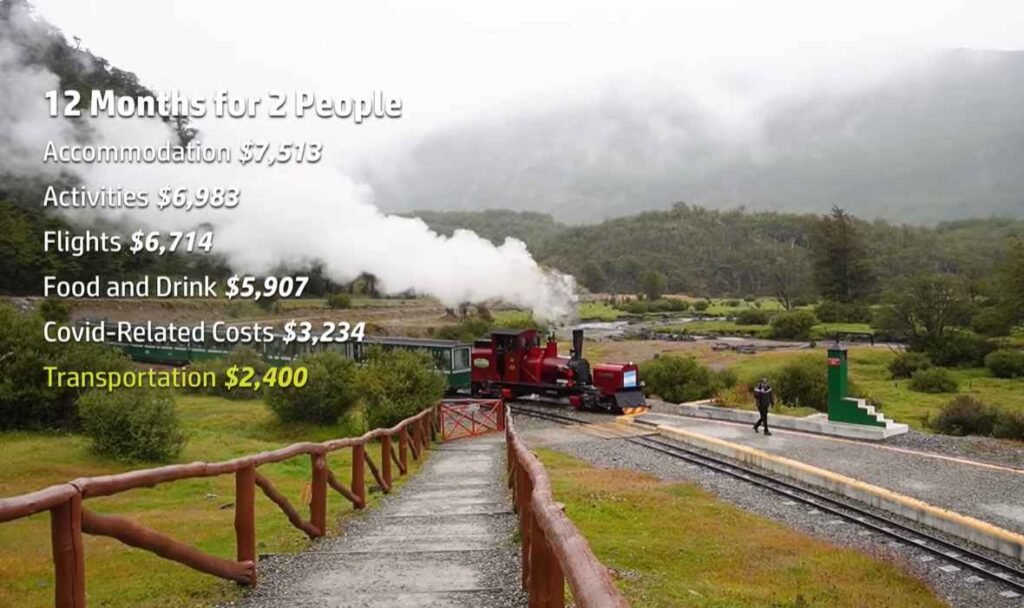

Breaking Down The Costs

Planning a long-term travel adventure stirs up excitement and wonder.

Yet, before setting off to explore the world, a critical step is to understand every cost involved. ‘

Breaking Down the Costs’ is your treasure map to meticulously planning your budget, ensuring your journey is as stress-free as it is thrilling.

Anticipating Travel Expenses

Pre-travel expenses often go unnoticed but can impact your budget significantly. Consider the following:

- Travel insurance: A safety net when abroad.

- Visas and vaccinations: Country-specific requirements.

- Travel gear: Reliable backpacks and suitable clothing.

- Flight costs: Often the largest initial expense.

- Accommodation bookings: The first few nights are covered.

Research each item thoroughly. Hunt for deals. Save money where you can.

Daily Costs On The Road

While wandering the globe, keep a keen eye on daily expenses to stay on budget:

| Category | Expense |

|---|---|

| Accommodation | Hostels, hotels, guesthouses |

| Food | Local markets, restaurants, cooking |

| Transportation | Buses, trains, ride-sharing |

| Activities | Sightseeing, tours, experiences |

| Others | Laundry, toiletries, souvenirs |

Track spending daily. Remove guesswork. Enjoy your travels without financial worry.

Creating A Savings Plan

Dreaming of extensive travel brings forth excitement and the need for a careful financial roadmap.

Creating a Savings Plan is vital. It turns dreams into actionable goals.

Assessing Your Income

Begin with a clear picture of your monthly income. Use online tools or apps to help you visualize.

- Check pay stubs for accurate figures.

- List all income sources, including side hustles.

This step sets the stage for your savings journey.

Allocating Savings For Travel

Add additional rows as needed

| Expense | Current Cost | New Budget | Savings for Travel |

|---|---|---|---|

| Groceries | $300 | $250 | $50 |

| Entertainment | $100 | $50 | $50 |

Identify non-essential expenses. Redirect funds into a dedicated travel savings account.

Consider setting up automatic transfers to simplify the process.

Remember, small changes bring big results over time. Stay committed to your savings target. Your future adventures await!

Harnessing Technology For Budgeting

Achieving a dream of long-term travel starts with smart planning, particularly budgeting.

The power lies in the palm of your hand, quite literally. Smartphones and digital services provide endless capabilities to help manage finances on the go.

With the right tools, staying within a budget while exploring the world becomes simpler.

Budgeting Apps For Travelers

Countless budgeting apps are at your fingertips. These apps help plan your travel finances before departure and keep spending in check while on the move. Compatibility with various devices ensures accessibility no matter where you are. Let’s dig into the top contenders:

- Mint: Offers an all-in-one glance at your finances.

- YNAB (You Need A Budget): Teaches you to manage and forecast your travel funds.

- Trail Wallet: Tailored for travelers, to track expenses on the road.

Online Tools To Track Spending

Online tools enhance your ability to monitor spending habits. These platforms often feature automatic currency conversion and categorize expenses for better insight. See below for some popular options:

- Google Sheets: Customizable and can be accessed from any device.

- Personal Capital: Provides a comprehensive view, linking all accounts in one place.

- Toshl Finance: Allows you to track expenses and plan for future costs.

Integrating these technologies into your travel routine can lead to substantial savings.

Keeping a keen eye on your budget during your travels is stress-free with these tools.

Start your journey on a financially savvy foot by embracing these digital budgeting aids.

Cutting Expenses Pre-travel

Budgeting for long-term travel begins before you hit the road. It’s vital to reduce expenses to save for your adventure. Here starts the pre-travel cost-cutting journey.

Reducing Monthly Bills

Shrinking your bills is the first step to amassing travel funds. Examine every monthly expense. Can you cut it down or cut it out completely?

- Cable subscriptions: Opt for cheaper streaming services or cut the cord entirely.

- Utility usage: Turn off lights, unplug devices, and use energy-efficient appliances to lower bills.

- Gym memberships: Work out at home or outdoors to eliminate this cost.

- Insurance plans: Shop around for better rates or bundle services to save.

Adjusting these bills can save hundreds of dollars, crucial for long-term travel planning.

Lifestyle Changes For Higher Savings Rate

Adopting new habits can significantly boost your savings rate. Embrace simple changes with big impacts.

- Eat at home: Cooking saves more than dining out.

- Sell unused items: Turn clutter into cash.

- Use public transport: It’s cheaper than owning a car.

- Limit luxury: Skip the latest gadgets and fashion trends.

These lifestyle tweaks accumulate savings for your travel fund. Every penny counts as you prepare for an unforgettable journey.

Generating Additional Income

Generating Additional Income’ becomes a core strategy when planning long-term travel. The right approach can boost your travel budget significantly.

Diversifying your income sources ensures you have more financial freedom on your journey.

Side Hustles For Travelers

Exploring side gigs can open doors to new funds. The digital world offers endless possibilities.

- Freelancing: Utilize your skills remotely. Writing, graphic design, and programming are in demand.

- Tutoring: Teach a language or another subject online.

- Photo Selling: Travel photos can sell. Use stock photo websites.

Find a hustle that fits your travel schedule. Flexibility is key.

Selling Possessions For Travel Funds

Selling items you don’t need can add to your travel fund. Start simple.

| Item Category | Value Estimate |

|---|---|

| Electronics | $50-$500+ |

| Clothing | $5-$100+ |

| Furniture | $50-$1000+ |

Online platforms like eBay and Facebook Marketplace are perfect for sales.

Be strategic. Sell items well in advance of your departure.

Finding Affordable Accommodations

Imagine touching down in a new city with the world at your feet and a journey ahead. Staying on a budget means finding where to sleep without breaking the bank.

This part guides you through savvy accommodation choices that keep costs low and adventures high.

Cost-effective Lodging Options

Travel doesn’t have to drain your wallet, especially when it comes to finding a place to stay. Here are various alternatives that are both comfortable and economical:

- Hostels: Ideal for solo travelers, hostels often offer shared rooms at rock-bottom prices.

- Guesthouses: They can offer a more personal touch and often include breakfast.

- Budget Hotels: Look for no-frills chains that provide essential amenities.

- Apartments: Renting can save you money, especially for longer stays.

- Camping: Connect with nature and enjoy unbeatable prices at campgrounds.

Leveraging Networks For Stays

Personal connections can be the key to unlocking free or reduced-cost lodging. Here’s how your network can become a budget traveler’s asset:

- Reach out to Friends: A friend’s couch or spare room can offer a cozy stay.

- Social Media Groups: Join travel communities where members exchange free accommodation.

- House Sitting: Look after someone’s home while they’re away in exchange for free lodging.

- Home Exchanges: Swap your home with fellow travelers for mutual savings.

Tackling Transportation Costs

When planning long-term travel, getting around can take a huge slice of your budget. Finding cost-effective transportation means more money for experiences and extending your journey.

This section digs into strategies to save on both flights and ground travel, laying the groundwork for an adventure that’s as affordable as it is exciting.

Smart Flight Booking Strategies

Savvy travelers know that scoring cheap flights is an art. With the right approach, you’ll cut costs and traverse the skies without breaking the bank.

- Off-peak hours mean lower prices. Aim for mid-week, early morning, or late-night flights.

- Incognito mode prevents price hikes based on your search history. Always use it.

- Comparing prices across platforms can reveal hidden deals. Use multiple aggregators.

A table can help illustrate flight comparison findings:

| Website | Price | Flight Time |

|---|---|---|

| Airfare.com | $450 | Overnight |

| Skyscanner | $470 | Afternoon |

| Kayak | $460 | Early Morning |

Ground Travel Savings Tips

Landing at your destination is just the start. Moving around on land has its own set of savings tricks.

- Public transport is a wallet-friendly option. Buses and trains often offer passes for tourists.

- Rideshare or carpool services can split the costs. Look for apps popular in your destination.

- Renting a bike or walking not only saves money but also offers a local experience.

Budget travelers also tap into discount cards for transportation. Libraries, tourist centers, and hostels sometimes provide them.

More savings unfold when combining ground travel strategies. Plan routes in advance, and consider multi-use tickets.

Staying Financially Responsible While Traveling

Staying financially responsible while traveling is critical to ensuring your adventure doesn’t turn into a financial burden.

Effective budget management and preparation for the unexpected will lay the groundwork for an amazing, yet affordable, journey around the globe.

Daily Budget Management

Track spending with daily budget sheets. Use apps or a simple spreadsheet to monitor expenses. Group your spending into categories like food, lodging, and entertainment. Recognize patterns and adjust as needed.

- Set daily spending limits.

- Eat local and save.

- Use public transport over taxis.

- Identify free activities.

| Category | Daily Limit | Actual Spend |

|---|---|---|

| Food | $15 | $12 |

| Lodging | $30 | $28 |

| Entertainment | $20 | $18 |

Dealing With Unexpected Expenses

Set aside a safety net. Create an ‘unexpected costs’ fund before you leave. This money is for emergencies only.

- Start an emergency fund.

- Backup financial resources are a must.

- Consider travel insurance.

- Know the location of local embassies.

Ensure communication lines at home remain open. Friends or family can assist quickly if a financial hiccup occurs.

Frequently Asked Questions Of How To Budget For Long-Term Travel

What’s The Average Cost For Long-term Travel?

The average cost varies greatly depending on destinations, travel style, and accommodation choices. Budget travelers could spend as little as $50 per day, while mid-range might go up to $150 per day. Planning and research are essential for accurate estimates.

How Can I Save Money For Travel?

Start by setting a clear savings goal and timeframe. Cut unnecessary expenses and consider opening a dedicated travel savings account. Automating your savings can make the process consistent. Monitor your progress and adjust your budget accordingly to stay on track.

What Should Be Included In A Travel Budget?

A travel budget should include transportation, accommodation, food, activities, insurance, and emergency funds. Don’t forget to account for visas, vaccinations, and gear purchases. Always overestimate rather than underestimate to avoid surprises.

How To Budget For Unexpected Travel Costs?

Set aside a contingency fund within your budget, typically 10-15% of your total estimated travel expenses. This fund helps cover unforeseen costs such as medical emergencies, flight changes, or sudden price hikes.

Conclusion

Embarking on long-term travel is an exciting journey that requires smart financial planning. Mastering budgeting techniques helps turn daunting expenses into manageable costs. Remember, consistent tracking and flexible budgeting are your allies. Embrace this financial roadmap to enjoy your travels without the burden of fiscal stress.

Safe travels and savvy spending!